Demystifying PPLI

A Strategic Tool for Enhanced Wealth Growth and Protection

In today’s complex and ever-evolving world of wealth management, identifying strategies that not only preserve but also significantly enhance your legacy can feel like a continuous challenge. Many sophisticated tools exist, yet some of the most powerful often remain shrouded in complexity, known only to a select few.

One such invaluable, yet often misunderstood, instrument is Private Placement Life Insurance (PPLI). This exclusive tool is a key to unlocking a new realm of possibilities for high-net-worth individuals and families seeking advanced solutions for growth, protection, and intergenerational wealth transfer.

At Atom Risk Advisory, we are experts in cutting through the jargon to highlight how PPLI can reshape the future of your wealth.

In this blog, we’re diving into PPLI, exploring how this unique structure works and why it might be the strategic solution your portfolio needs.

What is Private Placement Life Insurance (PPLI)?

In essence, PPLI is a highly customised, institutionally priced life insurance policy designed specifically for high-net-worth (HNI) and ultra-high-net-worth (UHNI) individuals and family offices. Unlike the retail life insurance products available to the general public, PPLI is a “private placement”, which means it’s not publicly offered and is tailored to the specific needs and investment objectives of a qualified investor.

Think of PPLI not as a mere insurance policy, but as a sophisticated financial wrapper around a bespoke investment portfolio. While it includes a death benefit, its primary appeal for many lies in its ability to facilitate tax-efficient growth and asset protection across a broad spectrum of investments.

How PPLI Works: The Mechanics Behind the Power

A PPLI policy consists of two main components:

- The Insurance Contract: This is the legal agreement with an insurance carrier, providing a death benefit and a cash value component. The cash value is where the investment magic happens.

- The Investment Portfolio: This is where the true flexibility emerges. Unlike traditional variable universal life policies that offer a limited menu of publicly traded mutual funds and/or indexed funds, PPLI allows access to a much broader array of investment options. These can include hedge funds, private equity, real estate funds, and other alternative investments managed by institutional-grade managers, often with lower fees than their retail counterparts. The policyholder typically works with an investment advisor to select and manage these underlying investments, though the actual “owner” of the investments for tax purposes is the insurance carrier.

The crucial element is that the investment gains within the policy’s cash value grow on a tax-deferred basis. When structured correctly, policyholders can access these funds during their lifetime through tax-free withdrawals and loans, and upon death, the proceeds are typically paid to beneficiaries free of income and estate taxes.

The Strategic Advantages: Growth, Protection, and Legacy

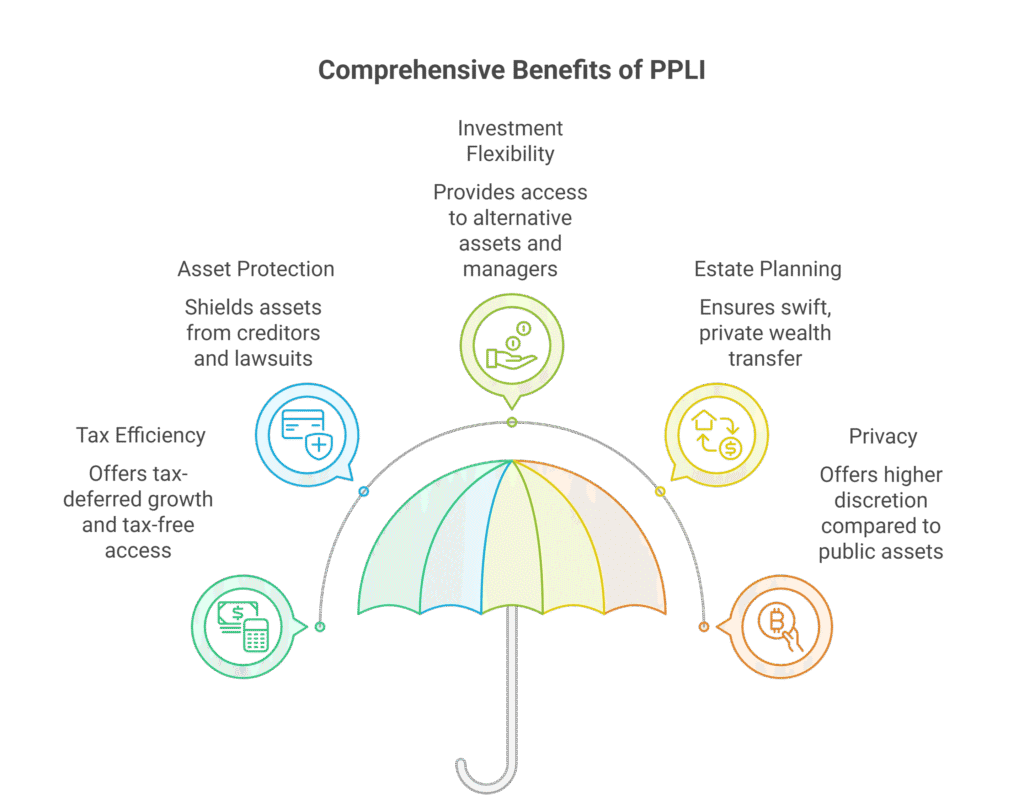

PPLI’s value lies in its multi-dimensional benefits, making it one of the most versatile tools in advanced wealth planning:

Unparalleled Tax Efficiency:

- Tax-Deferred Growth: Investments within the policy accumulate earnings without annual taxation, allowing for compounding growth over time.

- Tax-Free Access (Potentially): Policyholders can often access the cash value through withdrawals up to their basis and through policy loans, both of which can be tax-free if structured properly.

- Tax-Free Death Benefit: Proceeds generally pass to beneficiaries, income-tax-free, offering liquidity for estate taxes or other obligations.

Robust Asset Protection: Depending on jurisdiction, the cash value within a PPLI policy can be shielded from creditors, lawsuits, or bankruptcy claims – adding an extra layer of security.

Investment Flexibility and Access: Access to a wider universe of alternative assets and top-tier managers allows for bespoke portfolio construction beyond the constraints of public markets.

Streamlined Estate Planning: PPLI bypasses probate, ensuring a swift, private transfer of wealth across generations. Its tax-free death benefit also provides liquidity to cover estate obligations while preserving illiquid assets.

Enhanced Privacy: For families that value confidentiality, PPLI structures offer a higher level of discretion compared to publicly disclosed assets.

Who is PPLI For?

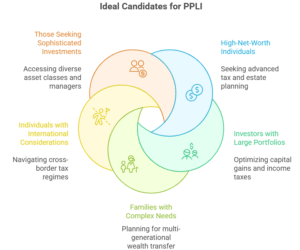

PPLI is not a one-size-fits-all solution. It’s best suited for:

- High and Ultra-High-Net-Worth Individuals: Those with substantial liquid assets seeking advanced tax and estate planning strategies.

- Investors with Large, Appreciated Portfolios: Individuals seeking to optimize their management of capital gains and income taxes.

- Families with Complex Estate Planning Needs: Those aiming for multi-generational wealth transfer, charitable giving, or providing for dependents with special needs.

- Individuals with International Considerations: PPLI can be particularly effective for cross-border planning, navigating different tax regimes, and maintaining compliance.

- Those Seeking Sophisticated Investment Opportunities: Investors looking for access to a broader range of asset classes and institutional managers.

Important Considerations

While PPLI offers transformative advantages, it also demands careful consideration:

- Significant initial premium commitments.

- Ongoing policy and management fees.

- A long-term horizon – benefits maximize over extended periods, making it a solid investment in the long run .

- Strict adherence to regulatory rules, including investor control guidelines.

For these reasons, navigating the intricacies and successful implementation requires collaboration with specialized advisors and experienced structuring teams.

Its effectiveness hinges on careful structuring, adherence to guidelines (particularly the “investor control” rules), and ongoing management by experienced professionals.

Is PPLI the Strategic Solution Your Portfolio Needs?

PPLI represents a sophisticated approach to wealth management, offering a unique blend of tax efficiency, asset protection, and investment flexibility that few other tools can match. It is a strategic architecture for wealth and testament to strategic foresight and meticulous planning.

If you’re seeking to enhance your wealth structure with growth, resilience, and legacy preservation and seamless wealth transfer, PPLI may be the missing piece.

At Atom Risk Advisory, our role is to demystify complex financial instruments and tailor them to align with your family’s aspirations.

Ready to Unlock the Potential?

We invite you to schedule a confidential consultation with one of our seasoned wealth advisors and our in-house Chief Investment Officer. Together, we can help you cut through complexity and unlock the full power of your wealth.