The Equalizer: Life Insurance for Fair Family Estates

How do you ensure fairness when a family business is the centerpiece of your estate?

For many entrepreneurs, this question weighs heavily. A thriving business may represent decades of vision, sacrifice, and determination, but it also presents a unique challenge: unlike liquid assets, a business cannot be neatly divided.

This is where life insurance emerges as one of the most powerful yet underutilized strategies in estate planning – an equalizer that ensures balance, harmony, and clarity in succession.

The Challenge: Business vs. Balanced Legacy

Imagine a successful entrepreneur who has built a business worth millions, the cornerstone of their wealth and identity. Their dream is to see the enterprise continue through two children who are actively involved in managing and growing it. The vision is that each of them inherits a 50% stake in the business.

But there is also another child who is not part of the business. The parent’s core desire is simple yet profound: all three children should inherit an equal 33% share of the overall estate.

Here lies the dilemma. If the business is transferred entirely to the children who are active in it, the one who is not risks being excluded from an equal share. Without careful planning, such an arrangement could leave that child with significantly less, planting seeds of imbalance and, potentially, family conflict.

The Solution: A Strategically Structured Life Insurance Policy

The solution lies in a strategically structured life insurance policy. Recognizing that the business will pass directly to the active heirs, the parent secures a life insurance policy naming the non-business child as the beneficiary. On the parent’s passing, the payout from the policy goes directly to this child, effectively equalizing the inheritance.

This approach allows the children involved in the enterprise to inherit and continue the business undisturbed, while the other child is provided with resources of their own – no forced sales, no buyout negotiations, no resentment. It is an elegant solution that safeguards both the continuity of the family enterprise and the unity of the family itself.

A Simple Illustration

If the business is valued at USD 2 million, the parent could arrange a USD 1 million life insurance policy. Upon succession:

-

The two children in the business each inherit assets valued at USD 1 million.

-

The third child receives USD 1 million from the life insurance payout.

Now, the parent’s overall estate includes both the business (USD 2 million) and the life insurance proceeds (USD 1 million), totaling USD 3 million. Each child receives USD 1 million, ensuring a perfectly balanced one-third share.

Here, life insurance becomes the crucial planning tool, providing fairness without requiring business assets to be sold or debts to be raised. This elegant solution strengthens family harmony, protects continuity of the enterprise, and fulfils the parent’s vision of an equitable legacy.

Why Life Insurance is the True Equalizer

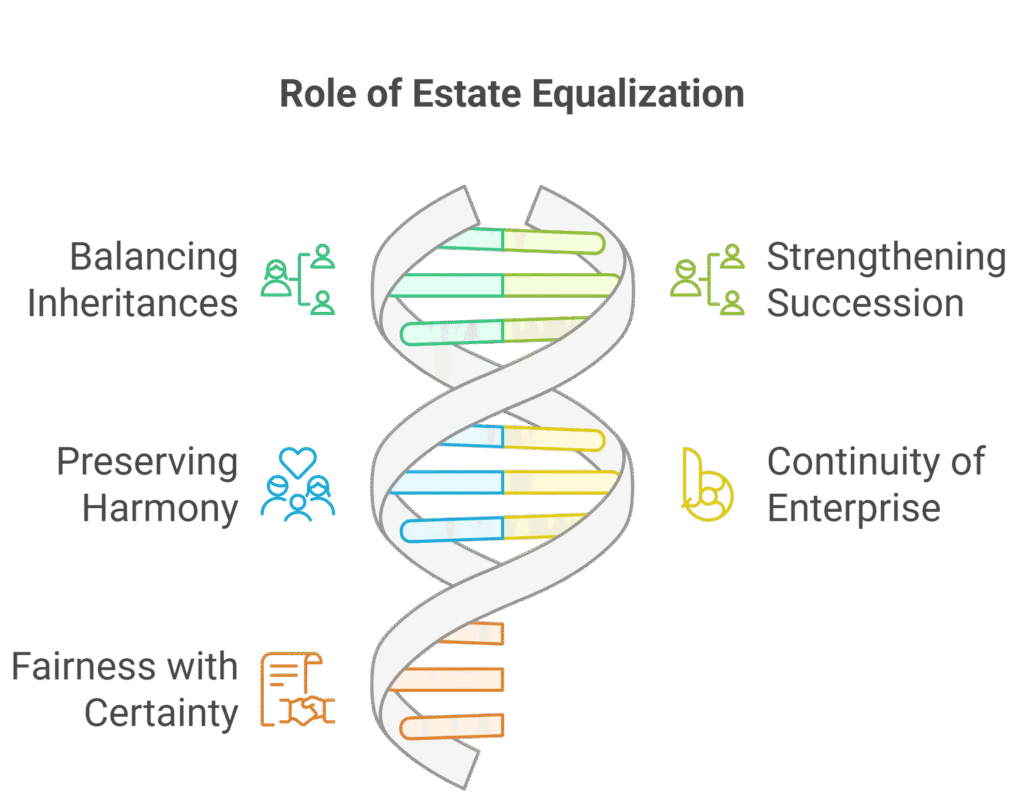

Life insurance, when viewed through the lens of estate equalization, is more than just a financial product – it is a critical element of succession planning. Its strengths lie in its ability to create fairness and preserve harmony across generations:

Balancing inheritances: It ensures each heir receives an equitable share, even when the core estate includes indivisible assets such as a family business or property.

Strengthening succession planning: By aligning distributions with the founder’s vision, it provides a clear framework for how wealth and responsibilities pass to the next generation.

Preserving family harmony: By avoiding unequal treatment, it reduces the chances of conflict, resentment, or protracted disputes among heirs.

Continuity of enterprise: Active heirs can continue managing the family business without pressure to sell or restructure, while others still benefit fairly.

Fairness with certainty: A properly structured policy guarantees clarity in distribution, safeguarding the founder’s intention for balance and unity.

In this way, life insurance becomes more than a safeguard – it is a cornerstone of effective succession planning and a practical tool for creating a truly equal legacy.