Critical Illness Insurance

The Rising Global Relevance of Critical Illness Insurance

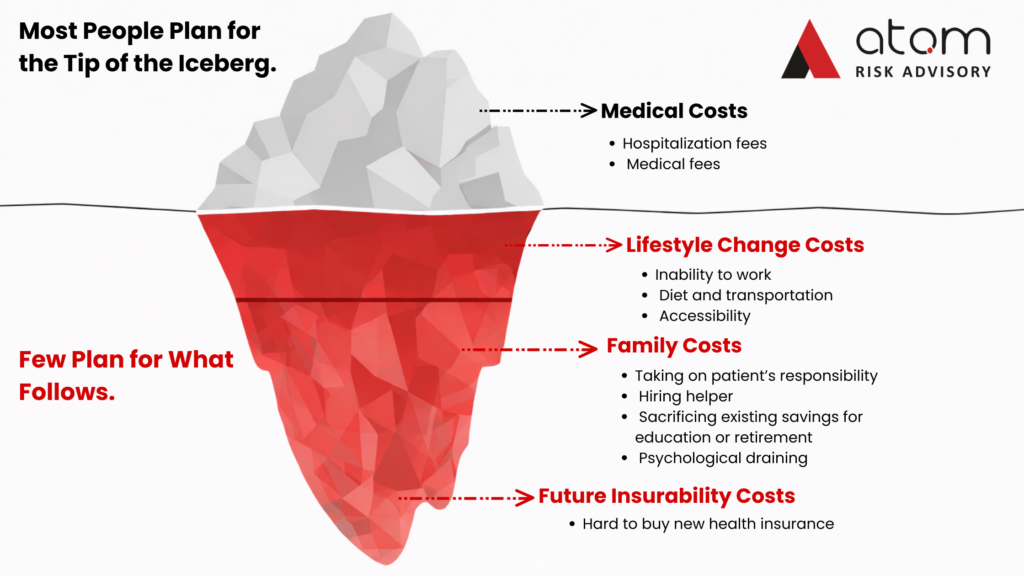

Critical illness is no longer a remote, age-specific, or short-term risk. Advances in healthcare have improved survival rates, but they have also extended recovery periods, increased long-term care needs, and amplified the financial consequences that follow a serious diagnosis. Today, a critical illness often triggers not only medical challenges, but sustained income disruption and ongoing expenses that extend well beyond hospitalisation.

At the same time, rising healthcare costs and shifting disease patterns have exposed the limitations of traditional health insurance structures. While medical policies address treatment, they rarely account for the broader financial impact of illness on households – ranging from lost earnings to lifestyle adjustments and long-term financial strain.

Against this evolving backdrop, critical illness insurance has moved beyond being a supplementary cover. It has become a strategic pillar of modern financial planning. It is designed to bridge protection gaps, preserve financial stability, and support individuals and families through periods of prolonged medical and financial uncertainty.

The Global Critical Illness Insurance Market

The global critical illness insurance market reflects the scale of the challenge and the urgency of the solution:

- Market Size: Estimated at USD 450 billion in 2025, projected to reach over USD 567 billion by 2030, highlighting sustained global demand.

- Leading Causes of Claims:

Cancer dominates, accounting for 40 – 65% of claims worldwide, followed by heart disease and stroke. Other significant claims include kidney disease, neurological disorders such as multiple sclerosis, and emerging conditions including autism. - Demographic Shifts:

A striking 22% of claims in the UK arise from individuals under 40, underscoring the rising incidence of critical illnesses among younger adults. - Claims Settlement Rates:

Globally, 80–90% of claims are approved, although denial rates vary depending on market regulations and policy structures. - Financial Impact:

Critical illnesses impose substantial direct medical costs alongside loss of income, making insurance protection essential rather than optional. - Emerging Trends:

Modern policies now include mental health coverage, early-stage illnesses, and COVID-19 impacts. Rising claims among younger populations continue to drive product innovation.

Long-Term Outcomes:

Survivors often face ongoing health complications and high healthcare utilization, reinforcing the need for sustained, long-term financial protection.

Why People Should Have Critical Illness Cover

Critical illness insurance plays a vital role in personal financial security because it:

- Protects against financial devastation arising from high treatment costs, many of which fall outside traditional health insurance.

- Provides income replacement during recovery periods when the insured may be unable to work, preserving household stability.

- Offers flexibility, delivering lump-sum payouts that can be used for any purpose, medical or otherwise, including home care, travel, childcare, or debt repayment.

- Reduces psychological stress linked to financial uncertainty, supporting better mental health and recovery outcomes.

- Safeguards savings and retirement funds from being eroded by medical expenses.

- Supports family caregivers by easing the financial burden when a loved one falls critically ill.

- Is cost-effective, with premiums generally affordable, especially when purchased at younger ages.

- Fills gaps left by other insurance products, such as disability or hospital indemnity insurance, providing truly complementary protection.

In essence, critical illness insurance enables individuals to focus on healing – without the added worry of overwhelming expenses or lost income.

A Sophisticated Approach to Critical Illness Cover

What Atom Advisors Can Deliver

At Atom Risk Advisory, we are able to design and place a sophisticated suite of critical illness insurance products engineered to deliver comprehensive financial protection across different life stages.

Main Features of These Critical Illness Insurance Plans

- Extensive Coverage:

Coverage for 188 illnesses and 38 complex surgeries, spanning pediatric, adult, and advanced-age conditions. - Multiple Claims Capability:

Up to five claims allowed for major illnesses such as cancer, stroke, and heart attack. - Elimination of Waiting Periods:

Unlike traditional plans, waiting periods between critical illness claims are removed, enabling immediate claims on subsequent illnesses. - Premium Waiver Benefits:

Premiums are waived for 24 months after early-stage diagnosis, with ongoing waivers following major illness claim payouts. - Gender-Specific Benefits:

Enhanced protection for gender-specific illnesses, addressing differentiated health risks. - Baby Care Options:

Perinatal and neonatal coverage addressing both maternal and newborn health risks. - Coverage Reload Benefit:

Restores coverage after early-stage claims, ensuring continued full protection for future illnesses. - Riders:

Optional riders such as CI Protector Plus enhance coverage, while Death Coverage Reload maintains death benefit protection even after claims.

Advantages & Benefits for Individuals and Families

- Comprehensive lifelong protection, from newborns to seniors.

- Protection against multiple illnesses, with the ability to claim multiple times and no waiting periods.

- Financial relief during treatment and recovery, supported by lump-sum payouts and premium waivers.

- Flexibility in fund usage, extending beyond direct medical costs.

- Family-centric support, including Baby Care benefits and income replacement during illness.

- Guaranteed insurability options, allowing additional coverage purchases without underwriting at key life events.

Financial Resilience When It Matters Most

Critical illness insurance is no longer a “maybe-good-to-have” solution. It is an essential financial security tool in a world where serious health events are increasingly common, costly, and disruptive, often striking during peak earning years.