India’s Insurance Amendment Bill: 100% FDI, Strategic Restraint, and a Defining Moment for the Sector

The Indian Union Cabinet’s approval of the Insurance Amendment Bill, raising the Foreign Direct Investment (FDI) limit in insurance companies to 100%, marks one of the most consequential reforms in India’s insurance landscape in decades. At a time when insurance penetration remains structurally low, this policy shift is expected to unlock long-awaited global capital, expertise, and innovation into the sector.

Yet, the reform is not an unqualified liberalization. The exclusion of composite licenses and the absence of an open architecture framework signal a calibrated approach. It balances capital inflows with regulatory discipline. Together, these choices are likely to shape both the short-term competitive dynamics and the long-term evolution of India’s insurance market.

This blog explores what the Insurance Amendment Bill means for investors, insurers, intermediaries, and consumers, and how it could redefine the future of insurance in India.

Key Insight: Capital Infusion Meets Strategic Restraint

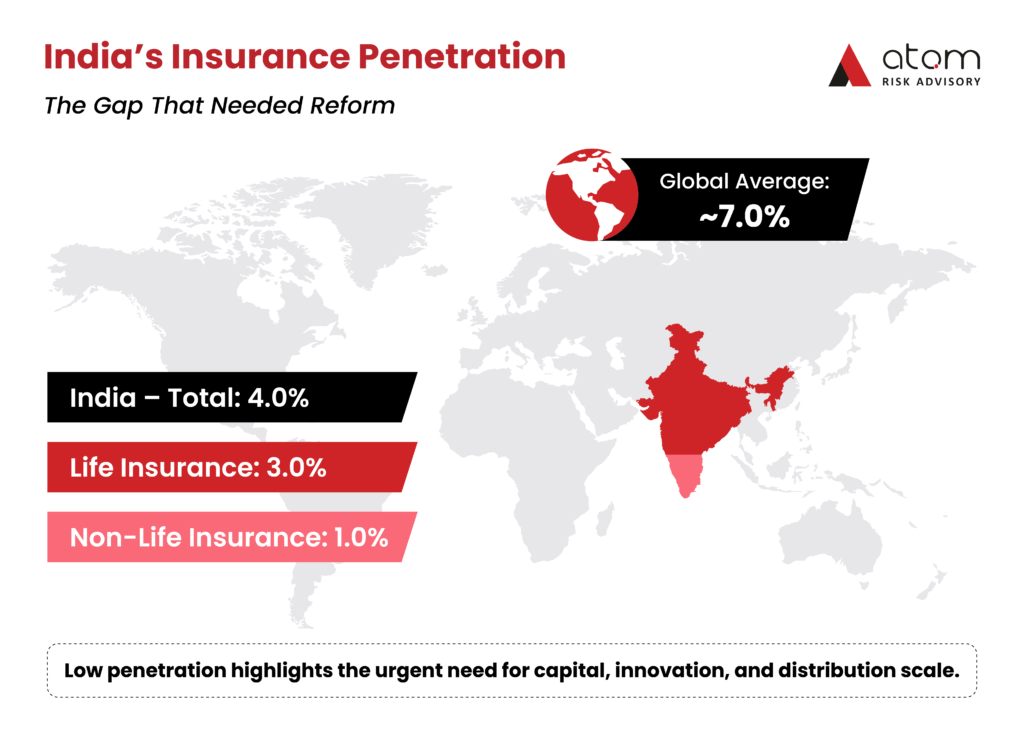

India’s insurance sector plays a vital role in economic resilience and individual financial security, yet it continues to lag global peers on penetration metrics. As of FY 2022-23, India’s overall insurance penetration stood at 4.0%, comprising 3.0% for life insurance and 1.0% for non-life insurance – significantly below the global average of approximately 7.0%.

This persistent gap highlights the urgent need for capital, innovation, and distribution depth. The decision to raise the FDI limit from 74% to 100% directly addresses these constraints.

By allowing full foreign ownership, the amendment is expected to:

- Unlock substantial foreign capital inflows

- Enable existing insurers to strengthen balance sheets and solvency

- Encourage new global insurers to enter the Indian market

- Introduce advanced underwriting practices, risk models, and technology

- Expand the range of products tailored to Indian consumers

However, the Bill’s structural guardrails are just as significant as its liberalization measures.

It excludes the option for composite licenses, meaning insurers cannot offer both life and non-life insurance products under a single entity. This approach promotes specialization, which could help prevent risk concentration and maintain regulatory clarity across distinct product categories.

Additionally, the lack of an open architecture mandate, which would have permitted agents to sell products from multiple insurers freely, suggests a preference for the existing tied-agency model. While this may limit immediate consumer choices and disrupt markets for brokers, it could also foster deeper relationships between insurers and their distribution channels, ensuring focused training and accountability.

Short-Term Impact: Capital, Competition, and Market Expansion

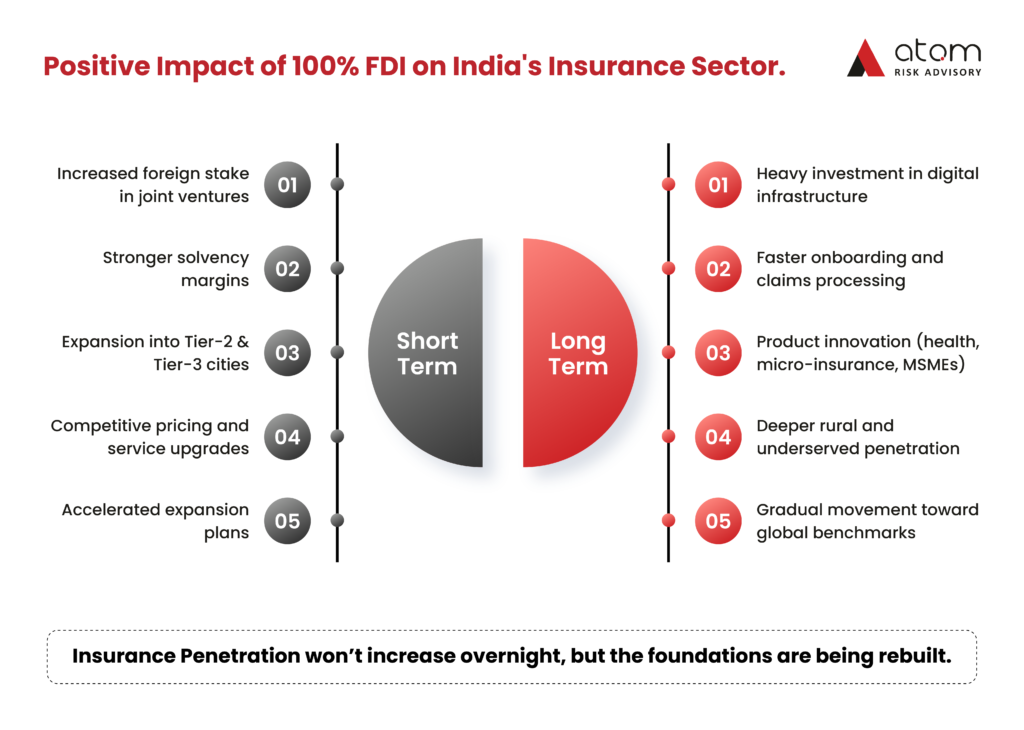

In the immediate aftermath of the reform, the industry is expected to witness a surge in activity:

- Foreign partners in existing joint ventures may increase their stakes

- Fresh capital infusions are likely to improve solvency margins

- Insurers will expand aggressively into Tier-2 and Tier-3 cities

- Heightened competition may lead to better pricing and improved service standards

- Distribution strategies will remain segmented and specialized across life and non-life businesses

For consumers, this phase is likely to translate into greater accessibility, stronger insurers, and more competitive offerings.

Long-Term Impact: Innovation, Inclusion, and Structural Transformation

Over the long term, the implications of 100% FDI are potentially transformative.

Sustained capital inflows will enable insurers to invest deeply in digital infrastructure, streamlining customer onboarding, underwriting, and claims processing. Technology-led efficiencies are expected to drive:

- Personalized and data-driven policy design

- Faster claims settlement and improved customer experience

- Scalable distribution models for underserved regions

Product innovation is also set to accelerate, with increased focus on:

- Micro-insurance solutions

- Health and wellness-linked products

- Tailored risk solutions for MSMEs

- Insurance offerings designed for rural and semi-urban populations

While insurance penetration may not rise overnight, consistent investment, innovation, and awareness campaigns are expected to gradually move India closer to global benchmarks, strengthening household financial security and economic resilience.

A Measured Reform with Long-Lasting Impact

The Insurance Amendment Bill represents a bold yet balanced step in liberalizing India’s insurance market. By combining full foreign ownership with structural prudence, the government has laid the foundation for sustainable growth rather than short-term disruption.

This reform is not merely about capital infusion. It is about reshaping the insurance ecosystem, fostering innovation, strengthening institutions, and expanding protection across India’s vast and diverse population.

How Atom Risk Advisory Can Help

As India’s insurance landscape evolves, navigating regulatory shifts, capital strategies, and market entry decisions requires deep sector expertise and global perspective.

Atom Risk Advisory works closely with insurers, reinsurers, investors, and intermediaries to help them:

- Assess regulatory and structural implications of reforms

- Design market entry and expansion strategies

- Build compliant, future-ready insurance and risk solutions

- Align global capabilities with India’s unique market dynamics

Connect with Atom Risk Advisory to explore strategic insurance and risk solutions tailored to your long-term objectives.